Forex trading has gained immense popularity over the years, raising the question: Is forex trading profitable? Many individuals venture into this sector seeking quick financial gains, yet the reality of forex trading is far more complex than it initially appears. In this article, we will explore the profitability of forex trading, the risks involved, the necessary skills and knowledge, and the strategies that can lead to success. To further enhance your trading journey, consider resources provided by is forex trading profitable Global Trading PK.

Understanding Forex Trading

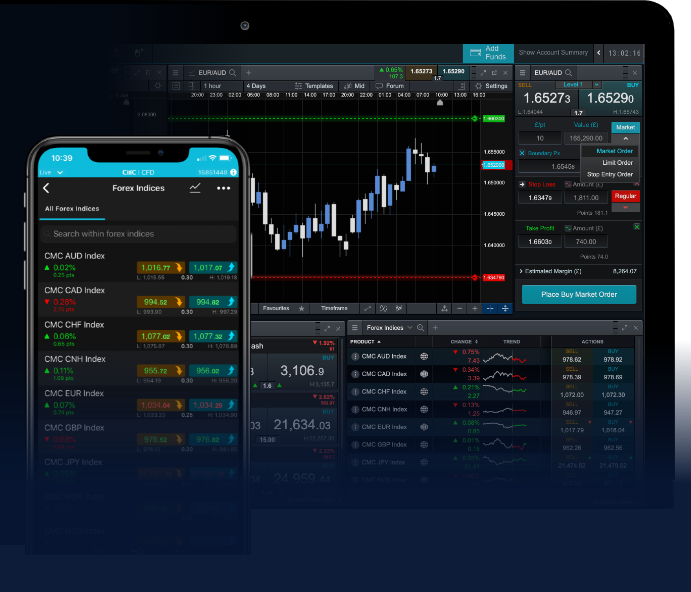

Forex, or foreign exchange, is the market for trading currencies. It is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Forex trading involves simultaneously buying one currency and selling another, which is why it is always quoted in pairs (e.g., EUR/USD, USD/JPY). Due to its liquidity and accessibility, many traders are drawn to this market.

Profitability Factors in Forex Trading

The profitability of forex trading depends on various factors:

- Market Knowledge: Understanding the basics of how the forex market operates is crucial. This includes recognizing the factors that influence currency movements, such as economic indicators, geopolitical events, and market sentiment.

- Risk Management: Effective risk management strategies can protect traders from significant losses. Setting stop-loss orders and knowing when to exit positions are essential skills.

- Trading Strategy: Developing and adhering to a well-defined trading strategy is paramount. Whether one chooses technical analysis, fundamental analysis, or a combination of both, a strategic approach consistently yields better results than impulsive trades.

- Emotional Resilience: Trading can evoke strong emotions, leading to irrational decisions. Successful traders cultivate emotional discipline and stick to their trading plans, regardless of market fluctuations.

The Risks Involved

While the potential for profit exists, forex trading also carries inherent risks. It is vital for traders to understand and mitigate these risks:

- Market Volatility: Forex markets can be highly volatile, with prices fluctuating rapidly. This can lead to substantial gains or significant losses.

- Leverage Risks: Many forex traders use leverage to amplify their trades, which can magnify profits but also magnify losses. A small shift in the market can result in substantial financial consequences.

- Psychological Pressure: The emotional strain of trading can lead to burnout and poor decision-making. It’s important for traders to recognize this pressure and develop techniques to manage emotions effectively.

Strategies for Successful Forex Trading

To increase profitability in forex trading, consider the following strategies:

- Develop a Trading Plan: A solid trading plan outlines your goals, risk tolerance, and trading strategy. Sticking to your plan can help you remain disciplined and avoid emotional trading.

- Utilize Technical Analysis: Analyzing price charts to identify trends and patterns can help traders make informed decisions. Using indicators such as moving averages and RSI can provide insights into potential price movements.

- Stay Updated with Fundamental Analysis: Economic news and events play a crucial role in currency valuations. Keeping abreast of economic indicators, interest rates, and political changes can provide a competitive edge.

- Practice with a Demo Account: Before risking real money, it’s wise to practice trading strategies on a demo account. This helps traders understand how markets work without financial pressure.

Assessing Your Own Profitability

To determine if forex trading can be profitable for you, consider the following steps:

- Set Clear Goals: Establish what you aim to achieve with forex trading, whether it’s supplementary income or full-time trading.

- Educate Yourself: Invest time in learning about the forex markets, trading strategies, and risk management techniques.

- Start Small: When starting, trade small amounts to gain experience and build confidence without risking large sums of money.

- Analyze Your Performance: Keep a trading journal to track your trades, strategies, and emotions. Regularly reviewing your performance can help identify strengths and weaknesses.

Conclusion

In conclusion, while forex trading can indeed be profitable, it requires significant knowledge, skill, and discipline. The pathway to success involves understanding the market, employing effective risk management, and developing a robust trading strategy. It is essential to remain patient and realistic in your expectations, recognizing that profitability may not come immediately. By committing to continuous learning and improvement, traders can enhance their potential for profitability in the dynamic world of forex trading.