Forex options trading can be a powerful tool in the arsenal of a trader, providing the ability to hedge against market movements or to speculate on directional changes efficiently. In this article, we’ll explore various strategies that can enhance your forex options trading skills and potentially lead to success. For detailed resources and additional insights, feel free to visit forex options trading strategy trading-connexion.com.

Understanding Forex Options

Before diving into strategies, it’s essential to understand what forex options are. A forex option gives traders the right, but not the obligation, to buy or sell a currency pair at a predetermined price before the option expires. This characteristic allows traders to manage risk while capitalizing on potential price movements.

Types of Forex Options

There are two primary types of forex options:

- Call Options: These give the holder the right to purchase a currency pair at a specified price (strike price) within a given time frame.

- Put Options: These allow the holder to sell a currency pair at the strike price within a specified period.

Basic Forex Options Trading Strategies

Now, let’s discuss some fundamental strategies that every forex options trader should consider:

1. Hedging

One of the primary uses of options in forex trading is to hedge against unfavorable market movements. If you hold a long position in a currency pair and are concerned about potential downward movement, purchasing a put option can protect your investment. This way, if the market does move against you, the gains from the put option can offset the losses from the underlying position.

2. Speculation

Traders can also use options for pure speculation. For instance, if you believe that the EUR/USD pair will rise, you might purchase a call option. Should the currency pair increase above the strike price, the call option can generate significant profits relative to the initial premium paid.

3. Straddles and Strangles

These strategies involve buying both call and put options with the same expiration date. A straddle entails buying options at the same strike price, while a strangle involves purchasing options at different strike prices. These strategies are excellent for traders anticipating significant market moves but uncertain about the direction.

Advanced Forex Options Trading Strategies

Once you’ve grasped the basics, consider implementing advanced strategies:

1. Spreads

Options spreads involve buying and selling options simultaneously to capitalize on a specific market outlook while limiting potential losses. Common spreads include bull spreads, bear spreads, and butterfly spreads.

2. Iron Condor

This strategy consists of four options: selling an out-of-the-money call and put option while buying a further out-of-the-money call and put option. The goal is to profit from low volatility in the underlying asset, ideally allowing all options to expire worthless.

3. Calendar Spreads

This strategy involves buying and selling options with the same strike price but different expiration dates. A trader can benefit from time decay, as the shorter-term option will lose value more rapidly than the long-term option.

Risk Management in Forex Options Trading

Regardless of the strategies employed, risk management remains paramount in options trading. Here are key aspects to consider:

1. Position Sizing

Determining the appropriate size for each position is crucial. Never risk more than a predetermined percentage of your capital on a single trade.

2. Stop-Loss Orders

Utilizing stop-loss orders can help mitigate losses. Set clear exit points before entering the trade to avoid emotional decision-making.

3. Diversification

Don’t place all your bets on a single currency pair. Diversifying your trades across different pairs can reduce overall risk.

Tools for Forex Options Trading

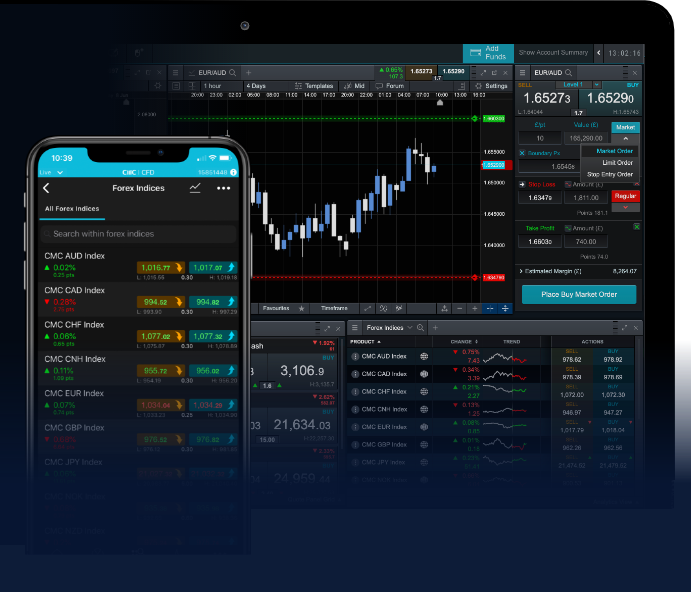

To succeed in forex options trading, it is essential to utilize the right tools and platforms. Many online brokers now offer comprehensive trading platforms with integrated charting tools, market analysis features, and real-time data feeds. Some popular tools include:

- MetaTrader 4/5: A widely used trading platform that supports automated trading and sophisticated analysis.

- TradingView: An excellent tool for performing technical analysis and social trading.

- Broker Platforms: Most brokers offer proprietary platforms with options trading capabilities, ensuring a user-friendly experience.

Final Thoughts

Forex options trading can present lucrative opportunities for traders willing to learn and adopt sound strategies. Understanding the different types of options, developing a strategic approach, managing risk effectively, and utilizing the right tools can significantly influence your trading success. As in all forms of trading, continuous education, market analysis, and adaptive strategies are vital to staying proficient in the ever-evolving forex market.

Whether you’re a beginner or an experienced trader, refining your forex options trading strategy can lead to better decision-making and improved profitability. Make sure to stay updated with market trends, practice with demo accounts, and keep refining your strategies over time.