In the fast-paced world of finance, trading forex online Jordan Brokers stands out as an essential partner for traders looking to make their mark in online forex trading. The forex market, known for its volatility and potential for lucrative returns, attracts millions of traders worldwide. Understanding the intricacies of this market is essential for achieving success. This article delves into the fundamentals of online forex trading, providing insights into strategies, tools, and techniques that can help both novice and experienced traders excel.

Understanding Forex Trading

Forex, or foreign exchange, refers to the global marketplace for buying and selling currencies. Forex trading involves speculating on the price movements of currency pairs, such as EUR/USD or USD/JPY. The primary aim of forex trading is to profit from the fluctuations in exchange rates between different currencies. Unlike traditional stock markets, the forex market operates 24 hours a day, five days a week, allowing traders to engage at their convenience.

Key Components of Forex Trading

Currency Pairs

In forex trading, currencies are quoted in pairs. The first currency in a pair is known as the base currency, while the second is the quote currency. For instance, in the EUR/USD pair, the euro is the base currency, and the U.S. dollar is the quote currency. Traders make decisions based on whether they believe the base currency will strengthen or weaken against the quote currency.

Pips

Pips, or “percentage in points,” are the smallest price movement in currency trading. Prices are typically quoted to four decimal places, with the last digit representing a pip. Understanding how pips affect trade calculations is crucial for determining profit and loss in each trade.

Leverage

Leverage allows traders to control larger positions with a smaller amount of capital. For instance, a leverage ratio of 100:1 enables a trader to control $100,000 with just $1,000. While leverage can amplify profits, it also increases the risk of significant losses. Thus, it is imperative to use leverage wisely and implement proper risk management techniques.

Developing Your Trading Strategy

To succeed in forex trading, it’s vital to develop and adhere to a well-defined trading strategy. Here are some key components to consider:

1. Technical Analysis

Technical analysis involves evaluating historical price data and using various indicators to predict future price movements. Traders utilize charts, trend lines, and patterns to make informed decisions. Popular technical indicators include moving averages, Relative Strength Index (RSI), and Fibonacci retracements.

2. Fundamental Analysis

Fundamental analysis entails examining economic indicators, news events, and geopolitical factors that may influence currency prices. Economic reports such as GDP, employment figures, and interest rate decisions play a significant role in currency valuation. Staying updated with global events can provide traders with insights into potential market movements.

3. Risk Management

Effective risk management is crucial in forex trading. Traders should set clear risk-reward ratios and utilize stop-loss orders to minimize potential losses. Determining the appropriate position size based on account balance and risk tolerance is also essential to ensure longevity in trading.

Selecting a Forex Broker

The choice of a forex broker can significantly impact a trader’s success. When selecting a broker, consider the following factors:

1. Regulation

Ensure that the broker is regulated by a credible financial authority. This adds a layer of security for your funds and ensures fair trading practices.

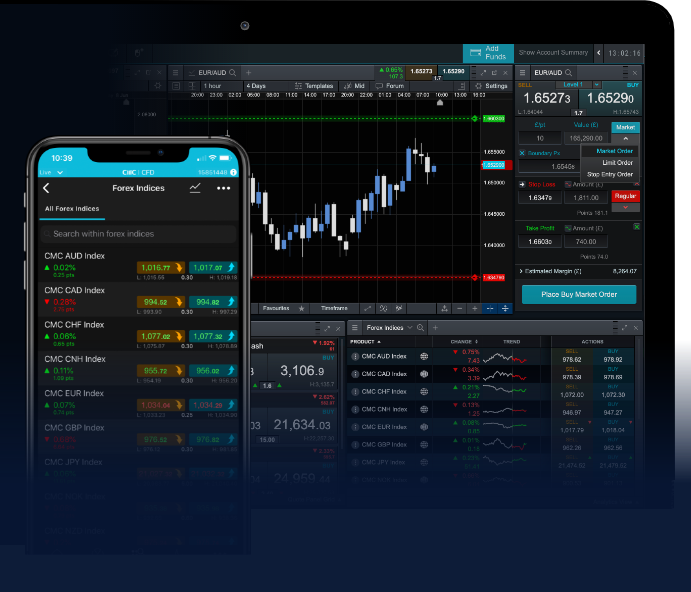

2. Trading Platforms

Look for brokers that offer user-friendly trading platforms equipped with essential tools and features. Popular platforms include MetaTrader 4 and 5, which provide advanced charting capabilities and automated trading options.

3. Fees and Spreads

Compare the fees and spreads offered by different brokers. Lower spreads can lead to higher profits, especially for day traders who execute multiple trades throughout the day.

Conclusion

Online forex trading presents immense opportunities for those willing to invest time and effort into learning the market. By understanding the fundamentals of forex trading, developing a robust trading strategy, and selecting a reliable broker, traders can enhance their chances of success. The journey of forex trading entails continuous learning and adapting to changing market dynamics. Engage with educational resources, practice through demo accounts, and remain disciplined in your approach. With perseverance and the right mindset, you can navigate the exciting world of forex trading and potentially achieve your financial goals.