Mastering Currency Trading: Your Guide to Forex Success

Currency trading, also known as Forex trading, has become one of the most popular forms of investment worldwide. With the rise of online trading platforms, individuals now have the opportunity to participate in the foreign exchange market with relative ease. If you’re considering diving into the world of Forex, this comprehensive guide will provide you with the knowledge and resources you need to succeed. For those starting out, it’s crucial to partner with reliable brokers, such as currency trading forex Forex Brokers in Kuwait, who can offer valuable support and trading tools.

Understanding the Forex Market

The foreign exchange market, also referred to as Forex or FX, is the largest financial market globally, with a daily trading volume exceeding $6 trillion. Unlike other financial markets, such as the stock market, Forex operates 24 hours a day, five days a week, giving traders the flexibility to trade at their convenience. The market involves trading pairs of currencies, where you buy one currency while simultaneously selling another.

Key Terminology in Forex Trading

Familiarizing yourself with key terminology is essential for navigating the Forex market. Some important terms include:

- Pip: A pip is the smallest price move that a given exchange rate can make based on market convention.

- Leverage: Leverage allows traders to control a larger position than their initial margin, thus enabling the potential for greater returns (and risks).

- Spread: The spread is the difference between the buy (ask) and sell (bid) prices of a currency pair.

- Lot Size: A lot size refers to the volume of a trade, which can be standard (100,000 units), mini (10,000 units), or micro (1,000 units).

Choosing a Forex Broker

Selecting the right Forex broker is a pivotal step in your trading journey. A reputable broker will provide you with a trading platform, access to market data, and assistance in executing trades. Here are a few factors to consider when choosing a broker:

- Regulation: Ensure the broker is regulated by a reputable financial authority to protect your investment.

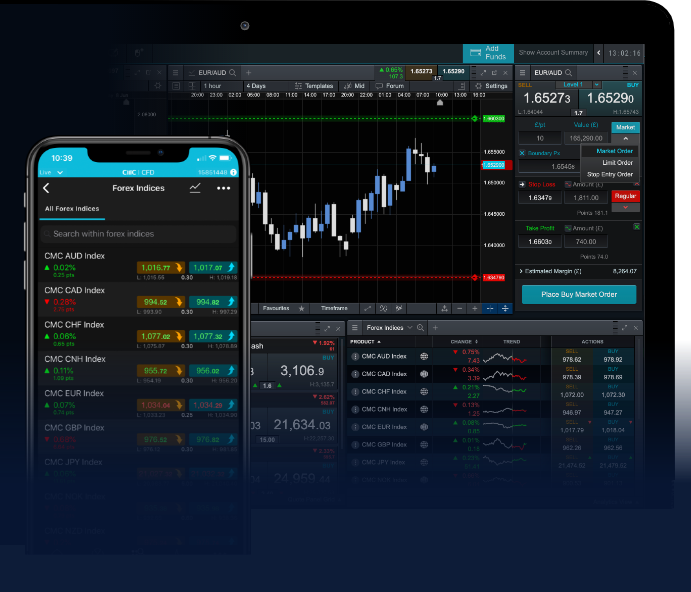

- Trading Platform: A user-friendly platform that supports various trading strategies and tools is essential.

- Customer Service: Reliable customer support can make a significant difference, especially for beginners.

- Fees and Spreads: Be aware of the fees involved, including spreads and commissions, as they can impact your profitability.

Fundamental Analysis in Forex Trading

Fundamental analysis involves evaluating economic indicators, news reports, and geopolitical events to predict currency movements. Key economic factors to consider include:

- Interest Rates: Central banks influence exchange rates by changing interest rates, affecting economic activity.

- Inflation Rates: Higher inflation typically devalues a currency, while lower inflation can lead to appreciation.

- Employment Reports: Strong employment data usually signifies a healthy economy, which can bolster the currency’s value.

- Political Stability: Countries with stable governments and economies tend to attract foreign investment, supporting currency value.

Technical Analysis in Forex Trading

Technical analysis focuses on historical price movements and trading volumes to forecast future trends. Traders use various tools, including:

- Charts: Line charts, bar charts, and candlestick charts help traders visualize price movements.

- Indicators: Tools such as Moving Averages, MACD, and RSI assist traders in identifying trends and entry/exit points.

- Support and Resistance Levels: These levels indicate where prices may bounce or reverse, helping traders make informed decisions.

Developing a Forex Trading Strategy

A well-defined trading strategy is critical for long-term success in Forex trading. Here are a few strategies you might consider:

- Day Trading: Traders open and close positions within the same day, capitalizing on short-term price movements.

- Swing Trading: This strategy involves holding positions for several days or weeks to take advantage of expected price shifts.

- Position Trading: Long-term traders hold positions for months or even years based on fundamental analysis.

Risk Management in Forex Trading

Effective risk management is essential to protect your capital while trading Forex. Consider implementing the following strategies:

- Set Stop-Loss Orders: These orders automatically close your position when it reaches a predetermined loss level.

- Diversify Your Portfolio: Avoid putting all your capital into a single trade or currency pair.

- Use Proper Position Sizing: Control the amount of capital you invest in each trade based on your overall account size.

Conclusion

Currency trading in the Forex market offers immense opportunities for profit, but it also comes with significant risks. By understanding the fundamentals of the market, conducting thorough analysis, and effectively managing your risk, you can enhance your chances of success. Always remember that education and practice are key; start with a demo account to gain experience before investing real money. As you embark on your Forex trading journey, ensure that you partner with reliable Forex Brokers in Kuwait to access valuable resources and support.