Sum-of-the-years’ digits depreciation does the same thing but less aggressively. Finally, units of production depreciation takes an entirely different approach by using units produced by an asset to determine the asset’s value. Depreciation expense is an important concept in accounting that allows businesses to allocate the cost of fixed assets over their useful lives.

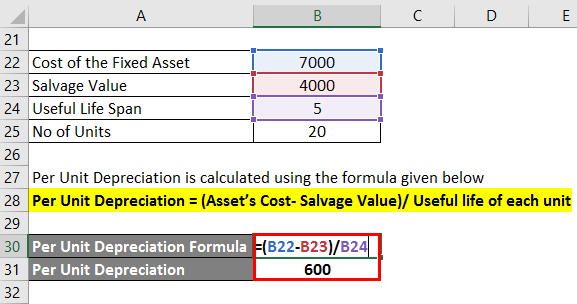

- Let us take another example to understand the unit of production method formula.

- So the business would deduct $1,450 in depreciation expense each year for 10 years under the straight-line method.

- Any way you choose to calculate the depreciation cost, you need to learn an essential formula to calculate your depreciables.

- Depreciation expense is recorded on the income statement as an expense, representing how much of an asset’s value has been used up for that year.

Mobile Apps For On-The-Go Asset Management

The straight-line depreciation method is a simple and reliable way small business owners can calculate depreciation. The straight-line depreciation method is important because you can use the formula to determine how much value an asset loses over time. By using this formula, you can calculate when you will need to replace an asset and prepare for that expense. Straight-line depreciation is an accounting method that measures the depreciation of a fixed asset over time.

Leveraging Depreciation For Strategic Asset Management

The useful life of an asset is the period during which it’s expected to be productive and beneficial to your business. There are various depreciation methodologies, but the two most common types are straight-line depreciation and accelerated depreciation. The recognition of depreciation on the income statement thereby reduces taxable income (EBT), which leads to lower net income (i.e. the “bottom line”). Assuming the company pays for the PP&E in all cash, that $100k in cash is now out the door, no matter what, but the income statement will state otherwise to abide by accrual accounting standards. The depreciation expense is scheduled over the number of years corresponding to the useful life of the respective fixed asset (PP&E).

Advantages of the Units of Production Method

Categorizing depreciation as a non-cash expense is vital for accurate cash flow planning. The depreciation deduction also serves to reduce tax liability despite no cash outlay, benefiting cash flow through lower income taxes. Getting salvage value right ensures only the total depreciable cost gets expensed and not any expected residual value the business expects to realize. The costs of these intangible assets can be deducted over their useful life via amortization or depreciation. Overall, accurately calculating depreciation is crucial for an accurate picture of the business’s financial position and performance. An accounting loss results from expensing a revenue-generating asset instead of capitalizing it and thus, not creating any future value for the company.

Enerpize is accounting-centric and, as such, is developed around accounting management needs. Undeniably, every business, big or small, must have an accounting system, manual or automated, to manage account needs end-to-end, expedite the reporting process, and stay compliant. According to the straight-line method of depreciation, your wood chipper will depreciate $2,400 every year.

What Is Accumulated Depreciation?

For assets purchased in the middle of the year, the annual depreciation expense is divided by the number of months in that year since the purchase. These assets are often described as depreciable assets, fixed assets, plant assets, productive assets, tangible assets, capital assets, and constructed assets. Using this new, longer time frame, depreciation will now be $5,250 per year, instead of the original $9,000. That boosts the income statement by $3,750 per year, all else being the same.

Depreciation is necessary for measuring a company’s net income in each accounting period. To demonstrate this, let’s assume that a retailer purchases a $70,000 truck on the first day of the current year, but the truck is expected to be used for seven years. It is not logical for the retailer to report the $70,000 as an expense accounting software in the current year and then report $0 expense during the remaining 6 years. However, it is logical to report $10,000 of expense in each of the 7 years that the truck is expected to be used. Businesses also use depreciation for tax purposes—namely, to reduce their total taxable income and, thus, reduce their tax liability.

To illustrate an Accumulated Depreciation account, assume that a retailer purchased a delivery truck for $70,000 and it was recorded with a debit of $70,000 in the asset account Truck. Each year when the truck is depreciated by $10,000, the accounting entry will credit Accumulated Depreciation – Truck (instead of crediting the asset account Truck). This allows us to see both the truck’s original cost and the amount that has been depreciated since the time that the truck was put into service.

After three years, the company changes the expected useful life to a total of 15 years but keeps the salvage value the same. With a book value of $73,000 at this point (one does not go back and “correct” the depreciation applied so far when changing assumptions), there is $63,000 left to depreciate. This will be done over the next 12 years (15-year lifetime minus three years already).

Companies can depreciate their assets for accounting and tax purposes, and they have a number of different methods to choose from. Whichever way they decide to calculate it, depreciation expense will represent the amount for a single period and accumulated depreciation is the sum of depreciation expenses recorded for the asset up to that point. Tracking the depreciation expense of an asset is important for accounting and tax reporting purposes because it spreads the cost of the asset over the time it’s in use. These accelerated techniques mean more depreciation expense hits the income statement early on compared to straight-line, resulting in lower taxable income in those initial years. The choice of depreciation method can have important impacts on a company’s financial reporting and cash taxes paid. Depreciation expense is an important concept in accounting that refers to the decline in value of a company’s fixed assets, like property, plant, and equipment (PP&E), over time.

Now that you know what straight-line depreciation is and why it’s important, let’s look at how to calculate it. Straight-line depreciation is often the easiest and most straightforward way of calculating depreciation, which means it can potentially result in fewer errors. Businesses should consult their accountant to utilize this deduction within the limits. In later years, accountants typically switch to straight-line depreciation to fully depreciate the asset. We’re a headhunter agency that connects US businesses with elite LATAM professionals who integrate seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.