Direct Labor Standard Cost and Variances

The variance would be favorable if the actual direct labor cost is less than the standard direct labor cost allowed for actual hours worked by direct labor workers during the period concerned. Conversely, it would be unfavorable if the actual direct labor cost is more than the standard direct labor cost allowed for actual hours worked. In this case, the actual rate per hour is $9.50, the standard rate per hour is $8.00, and the actual hours worked per box are 0.10 hours.

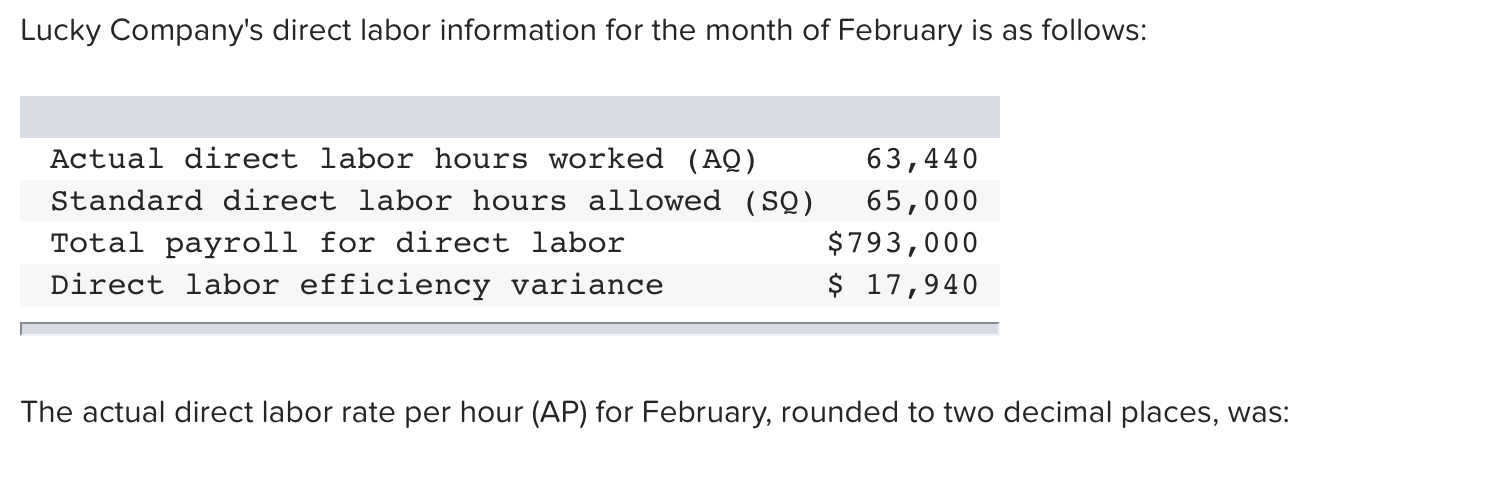

Direct Labor Variances

Excessive inventories, particularly those that are still in process, are considered evil as they generally cause additional storage cost, high defect rates and spoil workers’ efficiency. Due to these reasons, managers need to be cautious in using this variance, particularly when the workers’ team is fixed in short run. In such situations, a better idea may be to dispense with direct labor efficiency variance – at least for the sake of workers’ motivation at factory floor.

Rate Variance and Efficiency Variance

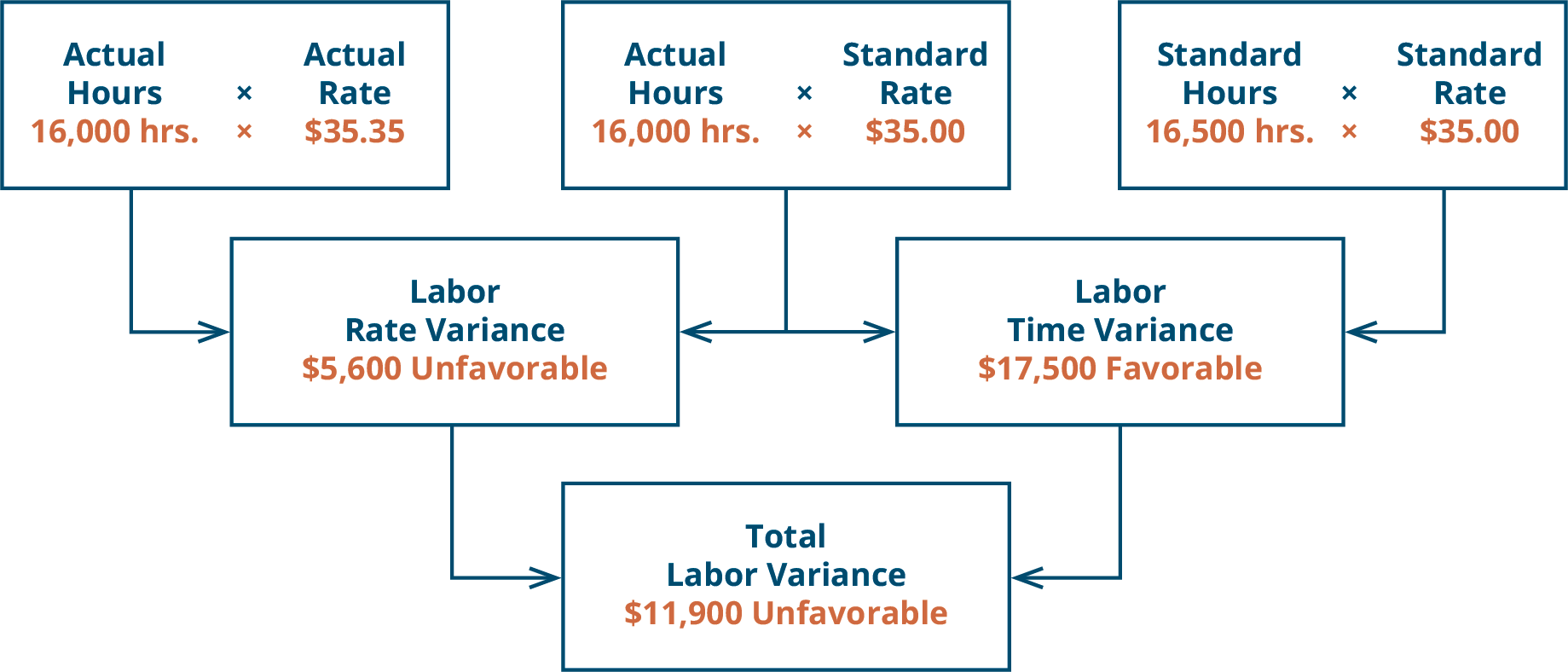

Direct labor variance is calculated by comparing the actual hours worked and the actual hourly wage rate against the standard hours allowed for the actual production level and the standard wage rate. The goal is to identify discrepancies that indicate either over- or under-utilization of labor resources or deviations in labor costs. The difference in hours is multiplied by the standard price per hour, showing a $1,000 unfavorable direct labor time variance. The net direct labor cost variance is still $1,550 (favorable), but this additional analysis shows how the time and rate differences contributed to the overall variance. The difference column shows that 100 extra hours were used vs. what was expected (unfavorable). It also shows that the actual rate per hour was $0.50 lower than standard cost (favorable).

- Direct labor efficiency variance pertain to the difference arising from employing more labor hours than planned.

- Understanding labor efficiency variance helps companies identify inefficiencies in their production processes and take corrective actions to improve labor productivity.

- ABC Company has an annual production budget of 120,000 units and an annual DL budget of $3,840,000.

- Changes in the labor market, such as a shortage of skilled workers or new labor agreements, can lead to wage adjustments.

- Because Band made 1,000 cases of books this year, employees should have worked 4,000 hours (1,000 cases x 4 hours per case).

Causes of direct labor efficiency variance

How would this unforeseen pay cut affect United’s direct labor rate variance? The direct labor rate variance would likely be favorable, perhaps totaling close to $620,000,000, depending on how much of these savings management anticipated when the budget was first established. If we compute for the actual rate per hour used (which will be useful for further analysis later), we would get $8.25; i.e. $325,875 divided by 39,500 hours. The direct labor (DL) variance is the difference between the total actual direct labor cost and the total standard cost. United Airlines asked abankruptcy court to allow a one-time 4 percent pay cut for pilots,flight attendants, mechanics, flight controllers, and ticketagents. The pay cut was proposed to last as long as the companyremained in bankruptcy and was expected to provide savings ofapproximately $620,000,000.

Get Your Questions Answered and Book a Free Call if Necessary

If, however, the actual rate of pay per hour is greater than the standard rate of pay per hour, the variance will be unfavorable. They provide valuable insights into the effectiveness of a company’s labor cost control and workforce utilization. By regularly analyzing labor variances, companies can identify discrepancies between actual and budgeted costs, understand the root causes of these variances, and take corrective actions. This proactive approach not only helps in managing labor costs more effectively but also contributes to better budgeting, forecasting, and strategic decision-making.

What is the difference between labor rate and efficiency variance?

There are two components to a labor variance, the direct labor rate variance and the direct labor time variance. The direct labor variance measures how efficiently the company uses labor as well as how effective it is at pricing labor. The other two variances that are generally computed for direct labor cost are the direct labor efficiency variance and direct labor yield variance. United Airlines asked a bankruptcy court to allow a one-time 4 percent pay cut for pilots, flight attendants, mechanics, flight controllers, and ticket agents. The pay cut was proposed to last as long as the company remained in bankruptcy and was expected to provide savings of approximately $620,000,000.

For example, a rush order may require the payment of overtime in order to meet an aggressive delivery date. Note that in contrast to direct labor, indirect labor consists of work that is not directly related to transforming the materials best tax software for expatriates in 2021 into finished goods. As mentioned earlier, the cause of one variance might influenceanother variance. For example, many of the explanations shown inFigure 10.7 might also apply to the favorable materials quantityvariance.

Regular variance analysis helps management identify areas where labor costs deviate from the budget, enabling them to take corrective actions promptly. This analysis supports better decision-making, enhances financial performance, and ensures resources are used optimally. This results in a favorable labor rate variance of $800, indicating that the company saved $800 on labor costs due to lower wage rates than anticipated.