Relationship Between Variances, Disposing of Variances

The simplest variance is the difference between what was budgeted to happen and what actually happened. Standard costs are sometimes referred to as the “should be costs.” DenimWorks should be using 278 yards of denim to make 100 large aprons and 60 small aprons as shown in the following table. If the balances are insignificant in relation to the size of the business, then we can simply transfer them the cost of goods sold account. This information comes from the right side of Figure 10.14 “Comparison of Variable and Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream”.

2.1 General Causes of Revenue Variances

- From there one can calculate variable overhead variances basically the same way as direct labor and direct materials variances.

- This pattern closely resembles the budgeting, costing, and variance analysis pattern followed by most modern firms of significant size.

- The variable overhead variance is a measure of the difference between the standard variable overhead costs and the actual variable overhead costs incurred for a given period.

- An unfavorable quantity variance suggests the firm is spending more time than budgeted on each unit produced.

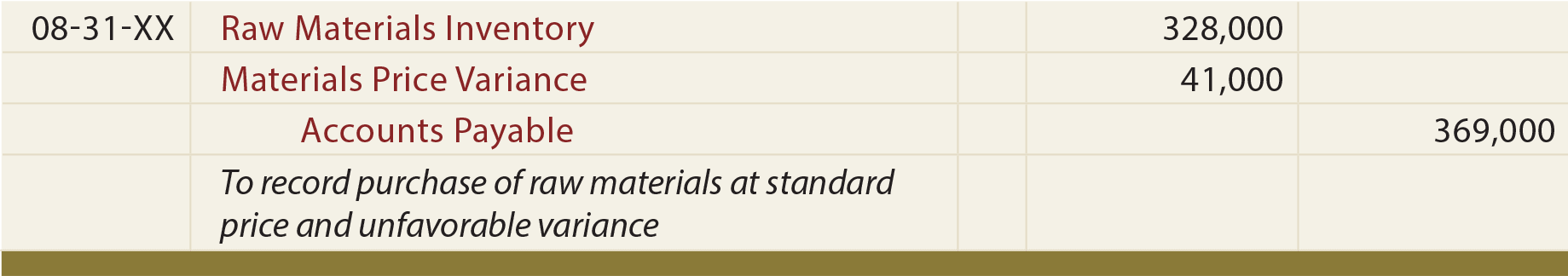

We will discuss later how to handle the balances in the variance accounts under the heading What To Do With Variance Amounts. The transactions with regard to accounting for material price variance would be. We will discuss how to report the balances in the variance accounts under the heading What To Do With Variance Amounts. Therefore, always consult with accounting and tax professionals for assistance with your specific circumstances. If $2,000 is an insignificant amount relative to a company’s net income, the entire $2,000 unfavorable variance can be added to the cost of goods sold.

5.4 Direct Materials Variance Journal Entries

Second, the two variances, added together, do not always equal the total difference between actual cost and flexible budget cost, since actual quantity purchased is usually different from actual quantity used. An unfavorable quantity variance suggests the firm is spending more time than budgeted on each unit produced. This might be due to poor training, poor retention (which lowers the average tenure and skill level of each employee), or excessive re-work due to low quality materials. With a little investigation a plan of action can be easily developed from this variance.

Variable Overhead Variance Journal Entry

Accounts payable reflects theactual cost, and the materials price variance account shows theunfavorable variance. Unfavorable variances are recorded as debitsand favorable variances are recorded as credits. Variance accountsare temporary accounts that are closed out at the end of thefinancial reporting period. We show the process of closing outvariance accounts at the end of this appendix. Throughout our explanation of standard costing we showed you how to calculate the variances. In the case of direct materials and direct labor, the variances were recorded in specific general ledger accounts.

6.3 Fixed Overhead Variances

Let’s also assume that the quality of the low-cost denim ends up being slightly lower than the quality to which your company is accustomed. This lesser quality denim causes the production to be a bit slower as workers spend additional time working around flaws in the material. In addition to this decline in productivity, you also find that some of the denim is of such poor quality that it has to be discarded. Further, some of the finished aprons don’t pass the final inspection due to occasional defects not detected as the aprons were made.

Recording Direct Materials Transactions

If the accountant recognizes that this type of variance is based on an incorrect standard, then there should be a journal entry to adjust the standard cost of the inventory item. This type of adjustment is only likely to arise if there is an ongoing program of actively investigating why variances are occurring. Unlike other variances, the firm starts from what was applied to WIP via the PDOH rate (i.e. Applied Cost, as shown below).

Even though budget and actual numbers may differ little in the aggregate, the underlying fixed overhead variances are nevertheless worthy of close inspection. The total direct labor variance was favorable $8,600 ($183,600 vs. $175,000). However, detailed variance analysis is necessary to fully assess the nature of the labor variance. As will be shown, Blue Rail experienced a very favorable labor gross profit definition rate variance, but this was offset by significant unfavorable labor efficiency. Standard costing can technically be combined with any of the costing systems described in Chapters 4, 5, and 6. That’s because the “standard costs versus normal costs versus actual costs” decision answers a different question than the “job-order costing versus activity-based costing versus process costing” decision.

If the inefficiencies are significant, the company might not be able to produce enough good output to absorb the planned fixed manufacturing overhead costs. This in turn can also cause an unfavorable fixed manufacturing overhead volume variance. The logic for direct labor variances is very similar to that of direct material. The total variance for direct labor is found by comparing actual direct labor cost to standard direct labor cost.

When forming the budget, variable and fixed overhead are typically added together as total overhead cost. Then, in job-order costing systems, this total overhead cost is used as the numerator to compute a PDOH rate. That is, a PDOH rate usually includes both variable and fixed overhead costs. Regardless, many companies calculate overhead variances and seem to get some good use out of them.

Many firms build these variances into several T-accounts, each bearing the name of the variance they represent. These T-accounts are debited or credited as costs are applied to WIP. But, on the other hand, some of those additional direct labor hours could also be due to inefficiency. Some of those extra hours could be from my workers watching Netflix at work instead of working.