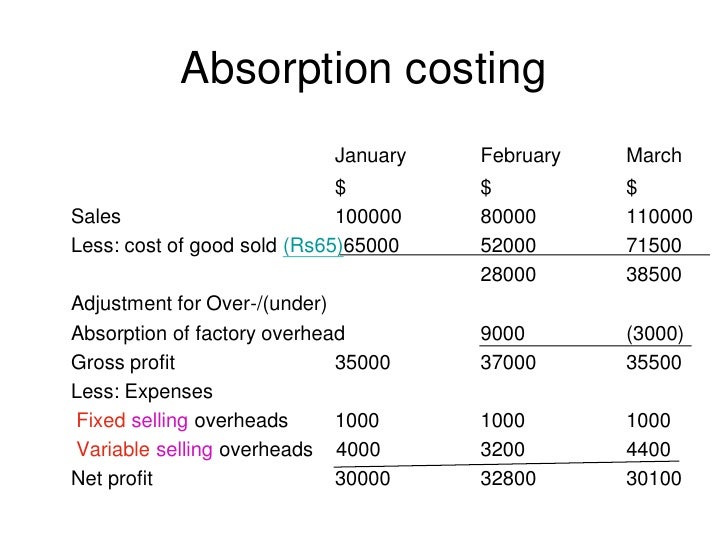

Every other part of the income statement becomes easy to calculate once you have gotten your cost per unit. It is important to note that the variable items are only calculated based on the number sold. This means that cost can only be expensed based on the amount sold while unsold items end up in the inventory. Most people, especially those in accounting, would have questions to ask about absorption costing and income statements. Absorption costing is often used interchangeably with the term full costing, and they are usually identified to have similar meanings. In contrast to the variable costing method, every expense is allocated to manufactured products, whether or not they are sold by the end of the period.

Find the talent you need to grow your business

Adjustments are made for the level of output differences if the actual output level is higher or lower than the normal output level. The amount of over-absorption is deducted from the total cost of items created and sold if the actual output level exceeds the typical output level. Retrospectively to any or all prior periods presented in the financial statements. The difference in the methods is that management will prefer one method over the other for internal decision-making purposes.

Calculating Ending Inventory Using Absorption Costing

Companies using absorption costing must understand these inventory valuation implications for accurate financial statement analysis when production volumes change. Operating expenses are represented on the income statement in the same way under absorption and variable costing. Both fixed and variable operating expenses incurred during the period are recorded. Revenue is recorded in the same way under both absorption costing and variable costing. It reflects the sales made during the period at the price agreed upon with customers. There is no difference in revenue recognition between the two costing methods.

Understanding Absorption Costing

Some fixed costs are incurred at the discretion of a company’s management, such as advertising and promotional expense, while others are not. It is important to remember that all non-discretionary fixed costs will be incurred even if production or sales volume falls to zero. The cost of setting up will be the same whether the printer produces one copy or 10,000. If the set-up cost is $55 and the printer produces 500 copies, each copy will carry 11 cents worth of the setup cost-;the fixed costs.

Additionally, fixed overhead is \(\$15,000\) per year, and fixed sales and administrative expenses are \($21,000\) per year. The difference between the absorption and variable costing methods centers on the treatment of fixed manufacturing overhead costs. Absorption costing “absorbs” all of the costs used in manufacturing and includes fixed manufacturing overhead as product costs. Absorption costing is in accordance with GAAP, because the product cost includes fixed overhead.

Absorption costing and variable costing differ slightly in how they define product and period costs. When accountants look at the costs of running a business, they label them as either product costs or period costs. It is very important for small business owners to understand how their various costs respond to changes in the volume of goods or services produced. The breakdown of a company’s underlying expenses determines the profitable price level for its products or services, as well as many aspects of its overall business strategy. In most cases, increasing production will make each additional unit more profitable.

It is assuming that all cost types can allocate base on one overhead absorption rate. The absorption rate is usually calculating in of overhead cost per labor hour or machine hour. The products that consume the same labor/machine hour will have the same cost of overhead. The term absorption costing refers to the method in which the entire production cost is allocated to each and every output proportionately.

External reports are generated for public consumption; in the case of publicly traded corporations, shareholders interact with external reports. External reports are designed to reveal financial health and attract capital. All fixed costs, including manufacturing overhead are reported on the income statement at the given amount. It is very important to understand the concept of the AC formula because it helps a company determine irs free file program delivered by turbotax the contribution margin of a product, which eventually helps in the break-even analysis. The break-even analysis can decide the number of units required to be produced by the company to be able to book a profit. Further, the application of AC in the production of additional units eventually adds to the company’s bottom line in terms of profit since the additional units would not cost the company an additional fixed cost.

- The deferral of tax payments can be advantageous for cash flow management, allowing businesses to utilize funds that would otherwise be paid in taxes for other operational needs or investments.

- This method of full absorption costing becomes very important is there is the need to follow the accounting principles for external reporting purposes.

- To calculate variable cost of goods sold, start with beginning inventory, add variable manufacturing costs and subtract ending inventory.

- Yes, you will calculatea fixed overhead cost per unit as well even though we know fixedcosts do not change in total but they do change per unit.

- The basic format is to simply show the sales less the cost of goods sold equal gross profit.

With a higher COGS under absorption costing, gross margin is lower compared to variable costing. Absorption costing can cause a company’s profit level to appear better than it actually is during a given accounting period. This is because all fixed costs are not deducted from revenues unless all of the company’s manufactured products are sold.

Using variable costing would have kept the costs separate and led to different decisions. Inventory valuation is a critical aspect of absorption costing, as it determines the cost of unsold inventory and cost of goods sold. Under this method, both fixed and variable manufacturing costs are included in the valuation of ending inventory on the balance sheet. Consequently, unsold inventory carries a portion of the fixed costs, which are not expensed in the income statement until the inventory is sold.