Is Forex Trading Profitable?

The world of forex trading has become increasingly popular over the past few decades, drawing in millions of traders eager to capitalize on the fluctuations in currency values. But the question remains: is forex trading profitable? Many individuals are attracted to the potential for high returns, but it’s essential to understand the mechanics of the market, the risks involved, and what it takes to succeed in this competitive environment. For those interested in making informed decisions, is forex trading profitable Global Trading PK offers valuable resources to kickstart your trading journey.

Understanding the Forex Market

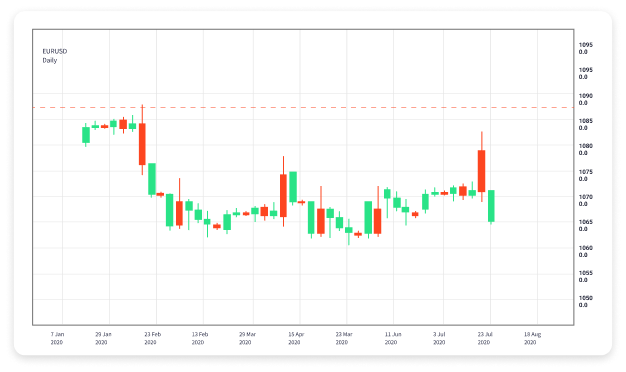

The foreign exchange market, or forex market, is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. This market operates 24 hours a day, five days a week, and involves the exchange of currencies. Traders speculate on price movements in currency pairs, aiming to buy low and sell high.

One of the key advantages of forex trading is the ability to leverage your investments. Brokers often allow traders to use margin, enabling them to control larger positions with a relatively small amount of capital. However, while leverage can amplify profits, it can also magnify losses, making it a double-edged sword.

Factors Influencing Profitability

Several factors determine the profitability of forex trading, including:

- Market Knowledge: Successful traders understand technical and fundamental analysis. Technical analysis involves studying price charts and patterns, while fundamental analysis focuses on economic indicators, news events, and political stability.

- Risk Management: Effective risk management strategies are crucial for long-term success in forex trading. This includes setting stop-loss orders, determining position sizes, and diversifying trades.

- Trading Psychology: Emotional control plays a significant role in trading success. Greed and fear can lead to impulsive decisions that may result in significant losses. Maintaining discipline and sticking to a trading plan is vital.

- Broker Selection: The choice of broker can significantly impact profitability. Factors such as spreads, fees, and trading platforms can influence the ultimate cost of trading.

Potential Returns and Risks

Forex trading can be highly profitable, but it is not without risks. According to various studies, while some traders report high returns, a substantial percentage of retail traders experience losses. In fact, it’s estimated that around 70-90% of retail traders lose money over time.

Potential returns in forex trading can be impressive. Experienced traders can achieve annual returns of 10-20%, while some claim much higher rates. However, beginners may find it challenging to turn a profit, especially in the initial stages. Many new traders fall into the trap of overtrading or mismanaging their risks, leading to significant losses.

Strategies for Success

To increase the likelihood of profitability in forex trading, traders should adopt proven strategies. Some of the most popular strategies include:

- Scalping: This involves making numerous trades throughout the day to capitalize on small price movements. Scalpers typically hold positions for a short time, often just minutes.

- Day Trading: Day traders open and close positions within the same trading day, avoiding overnight risks. This strategy requires constant monitoring of the market.

- Swing Trading: Swing traders hold positions for several days or weeks, attempting to profit from larger price movements. This strategy requires a good understanding of market trends and technical analysis.

- Position Trading: This long-term strategy involves holding positions for months or even years, based on fundamental analysis and economic indicators.

The Importance of a Trading Plan

Having a well-defined trading plan is crucial for success in forex trading. A trading plan outlines your trading goals, risk tolerance, strategies, and methods for analyzing the market. It serves as a roadmap to keep you disciplined and focused.

Additionally, continuously reviewing and adjusting your trading plan based on performance and market conditions is necessary. This adaptability can improve your chances of profitability in the long run.

Developing Skills through Education

Education is an essential part of becoming a successful forex trader. Many resources are available for aspiring traders, including online courses, webinars, and trading simulators. Gaining knowledge and practicing with a demo account can help you build confidence before risking real capital.

Furthermore, staying informed about global economic events, central bank announcements, and geopolitical developments can provide valuable insights into currency movements.

Conclusion

In conclusion, while forex trading can be profitable, it is not a guaranteed path to wealth. Success in the forex market requires a combination of knowledge, skill, and discipline. By understanding the mechanics of trading, implementing effective strategies, and adopting solid risk management practices, traders can increase their chances of achieving profitability. With careful planning and continuous education, forex trading can be a rewarding endeavor for those willing to put in the effort.

Ultimately, whether forex trading is profitable for you will depend on your dedication to learning, developing skills, and managing risks effectively. With the right approach and resources, traders can navigate the complexities of the forex market and potentially reap its rewards.